Pricing starts at just $50 & up. Services in English, Kreyòl, and Español

Taxes Made Easy

For Hardworking People

Tax preparation with a focus on Earned Income Tax Credit (EITC) and Child Tax Credit (CTC).

Simplifying Taxes in 3 Easy Steps

Book Your Free Consultation

Call or book online.

We'll guide you from the start.

Upload Your Documents

Upload Directly to Our Secure Portal.

It’s fast, easy, and keeps everything in one place.

File With Ease

Speak to our team of experts and file with ease.

Kids Come With Credits—Ask Us How to Get Yours!

The Child Tax Credit is your opportunity to ease some financial stress and focus on what matters—raising your family. Let us help you claim every dollar you’ve earned.

Get up to $2,000 per child in credits.

Avoid Mistakes When Filing for the CTC

Submit and relax.

We Know What It’s

Like to Hustle...

Tax Prep For Individual Families.

Child Tax Credit Guidance.

Health Insurance Enrollment

Did You Know We Offer More Than Tax Prep?

Comprehensive Real State Solutions.

Debt Consolidation

Long Term Insurance

Generational Wealth

IRS Hardship Refund.

Do You Qualify?

Drop your email and phone,

and we’ll check if you qualify.

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. You can reply STOP to unsubscribe at any time.

About Us

Tax prep for the hustlers, the dreamers, and the parents making it all happen.

At TNG Tax Services, we’ve been making tax season easy for over 20 years. With affordable pricing starting at just $50, personalized support, and services in English, Kreyòl, and Español, we’re here to help you every step of the way.

From individual taxes to small business filings, we’ve got you covered. Prefer to stay home? Upload your documents through our secure portal. Taxes don’t have to be stressful—let us handle it for you.

Tax Network Solutions

Trusted by South Florida families for 20+ years.

Frequently Ask Question

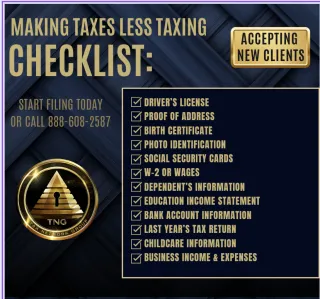

1. What do I need to bring to my tax appointment?

We keep it simple! Could you bring the following documents to your appointment: W-2s or income statements from your job(s) Any 1099 forms if you’re self-employed or received other income. A valid photo ID (like a driver’s license).Any other documents related to deductions, credits, or additional income (e.g., childcare expenses, student loan interest, mortgage statements).Not sure what you need? No worries! Just call us at [1-888-608-2587], and we’ll help you figure it out.

How much does it cost to file my taxes with TNG?

We’re proud to offer tax filing starting at just $50. That’s right—no hidden fees, no surprises. Whether you’re filing as an individual or a small business, we’ve got you covered with transparent pricing and expert support. Need something extra, like health insurance guidance or help with child tax credits? We’ll walk you through it, so you get the most out of your return.

Can I upload my documents instead of coming in?

Absolutely! We simplify the process so you can manage everything from home. Just follow these steps to upload your documents through our secure online portal:

1. Click this link to access the Client Portal.

2. Log in or create a new account.

3. After creating an account, answer a few questions about your yearly filing; you can even find out what your estimated refund might be!

4. Take a photo or upload your files, such as W-2s, 1099s, and your ID.

Once we receive your documents, our team will review them and get in touch if we need anything else. It's fast, secure, and stress-free!

Copyright 2025 . All rights reserved

Tax preparation pricing starts at $50, which includes basic individual tax filings.Additional charges may apply based on the complexity of your return, additional forms, or services required. Final pricing will be determined after reviewing your specific tax situation .